Stapling super: Reducing multiple accounts for employees

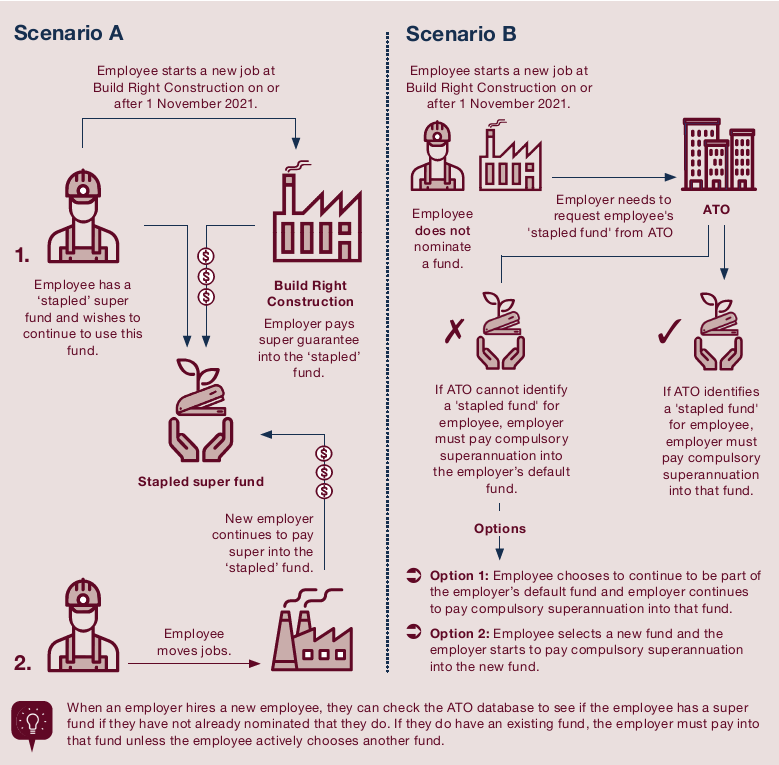

The new legislation will ensure that when an employee moves jobs, the super fund they used with their former employer will be ‘stapled’ and will automatically follow them.

Under current rules, if an employee changes jobs multiple times over their working life and does not nominate a superannuation fund to their employer, they could end up with multiple superannuation accounts, each charging their own fees and insurance premiums.

To prevent this from happening and to stop unintended accounts being created for employees, including for short-term jobs, the Your Future, Your Super legislation will require that a person’s super is ‘stapled’ to them (unless they actively choose to change funds) as they progress their employment.

The changes will apply to employees starting a new job from 1 November 2021.

If you need any assistance with understanding the stapling super, please do not hesitate to contact Lawrence (E: lawrence@wladvisory.com.au M: 0431 658 603). The ATO website also provides some additional information.

WL Advisory is a Chartered Accounting firm. We specialise in accounting, tax and advisory services for individuals and small businesses. Please visit our website for more information.