Latest News

Stay up to date

Director penalty notices

Director penalty notices If your company is falling behind with payment of certain taxes, directors may be held personally liable. To recap, there...

Federal Budget 2023

Federal Budget 2023 Introduction The 2023/24 Federal Budget was handed down on 9 May. It contains changes to business and personal taxation,...

Financing motor vehicles

Financing motor vehicles One of the most common decisions facing business is how to finance and account for the acquisition of a motor vehicle....

Upcoming trust distribution strategies

Upcoming trust distribution strategies Introduction If you run your business through a family trust, there’s some good news on the distribution...

Employee or contractor? – the Federal Court weighs in

Employee or contractor? – the Federal Court weighs in Introduction A recent Federal Court case has highlighted important superannuation guarantee...

Top cyber security tips for business

Top cyber security tips for business Introduction It is important you keep all your business, staff and client information secure. If your data is...

FBT exemption for electric vehicles

FBT exemption for electric vehicles Introduction With car fringe benefits one of the most common benefits provided by employers to employees, a new...

Reimbursement versus Allowances

Reimbursement versus Allowances Introduction Many employers assist workers with work-related expenses by reimbursing them or paying them an...

ATO finalises Section 100A guidance for Family Trusts

ATO finalises Section 100A guidance for Family Trusts final section 100A guidance Introduction Do you operate your business via a family trust? The...

New work from home record keeping requirements

New work from home record keeping requirements Introduction Are you one of the five million Australians who claim work from home deductions? If so,...

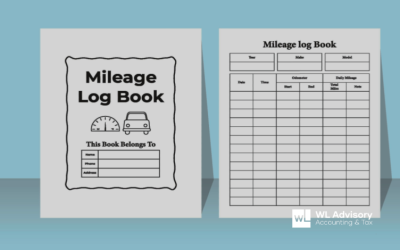

FBT and car logbooks

FBT and car logbooks With the end of the FBT year approaching, are your car logbooks in order? Requirements The operating cost method is used by...

ATO New-Year Resolutions

ATO New-Year Resolutions The ATO has released its new year resolutions…and there is not a gym in sight! According to the ATO the five new year’s...

The importance of cash flow forecasts

The importance of cash flow forecasts Introduction As we enter into the new year, with many economists predicting a slowing of the economy, planning...

Missed the Director ID Deadline?

Missed the Director ID Deadline? Have you missed the deadline to apply for a director identification number (director ID)? If so, you can still...

FBT exemption for electric vehicles

FBT exemption for electric vehicles Introduction Electric vehicles are set to become more affordable for both households and businesses after the...

Xmas gifts from employers

Xmas gifts from employers Christmas is traditionally a time of giving, including employers showing gratitude to their workers for a job well done...

Optus data breach

Optus data breach Introduction Following a recent cyber-attack, Optus customers are advised they could be at risk of identity theft. While Optus has...

Federal Budget 2022-23

Federal Budget 2022-23 Business and Individual Taxation The confirmation of lucrative income tax cuts, and the scrapping of a tax offset for low and...

Our Accreditations

When working with WL Advisory, you can guarantee that you’re partnering with professionals who provide the highest calibre of accounting and tax solutions.